Article Directory

Nvidia's "Off the Charts" AI Sales: We're Witnessing a Technological Cambrian Explosion

Okay, folks, let's talk about Nvidia. Not just the stock price, which, yes, had a bit of a rollercoaster after their Q3 earnings report, but about what those earnings actually mean. Forget the short-term jitters, the real story here is that Jensen Huang just casually dropped the phrase "Blackwell sales are off the charts." Off. The. Charts. That's not just good; that's paradigm-shifting.

Think about it: Nvidia isn’t just selling chips; they’re selling the picks and shovels for the new gold rush – the AI revolution. And the demand? Well, Huang says cloud GPUs are sold out. Sold. Out. It's like trying to find a decent graphics card during the pandemic all over again, but this time, it's not just gamers clamoring; it's entire industries building their future.

We saw the stock jump initially, buoying other AI players like AMD, Amazon, and Google, which is great. Then it wavered, which is… well, the market being the market. Peter Thiel’s fund selling off its Nvidia stake? SoftBank unloading billions? That's just noise. The real signal is in the underlying demand, the sheer, insatiable hunger for AI processing power.

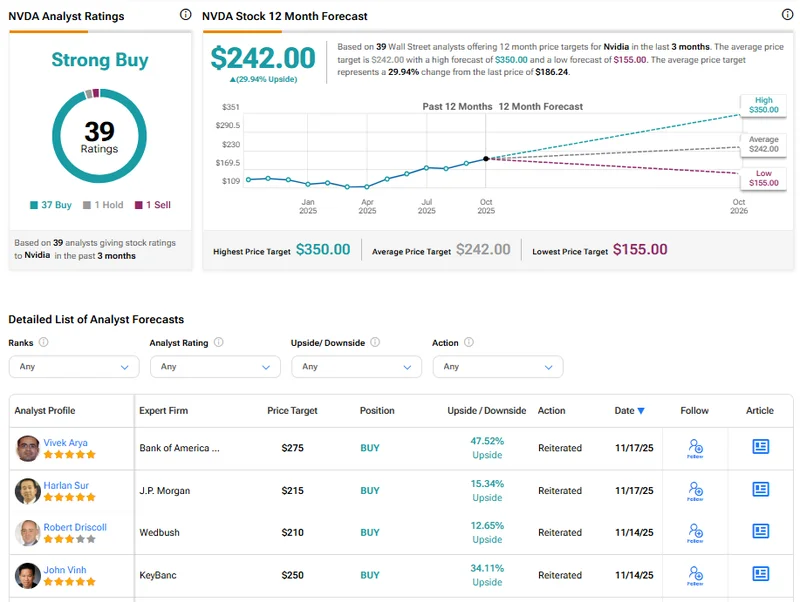

Nvidia's Q3 numbers speak for themselves: EPS of $1.30 on revenue of $57.01 billion, blowing past analyst estimates. The data center business brought in a staggering $51.2 billion! But here's the thing: these aren't just numbers on a spreadsheet; they represent a fundamental shift in how we compute, how we create, and how we interact with the world. It's like the shift from the abacus to the computer, or maybe even from horse-drawn carriages to the internal combustion engine. The scale of this is just staggering; it means the gap between today and tomorrow is closing faster than we can even comprehend.

Now, some folks, like Michael Burry, are raising concerns about companies artificially boosting earnings by understating depreciation. And that's a fair point. We need to be responsible, ethical, and transparent as we build this new AI-powered world. But let's not throw the baby out with the bathwater. The underlying trend is undeniable: AI is not just a buzzword; it's the driving force of technological innovation right now.

What does this mean for us? What does it mean for you? Imagine a world where AI-powered tools are as ubiquitous and easy to use as smartphones. Where doctors can diagnose diseases with unprecedented accuracy, where scientists can design new materials with revolutionary properties, and where artists can create breathtaking works of art with the help of intelligent algorithms. That future isn't some distant dream; it's being built right now, powered by Nvidia's chips.

I remember when I first really understood the potential of parallel processing. It was back at MIT, and we were trying to simulate complex protein folding. The computers we had at the time just weren't up to the task. But then, we got our hands on a cutting-edge GPU, and suddenly, the impossible became possible. I honestly just sat back in my chair, speechless. That's the feeling I get when I look at Nvidia's current trajectory.

And it's not just about the technology; it's about the community. I saw a comment on Reddit the other day that perfectly captured the excitement: "Nvidia is basically printing money, and that money is fueling the future." Maybe it's a bit hyperbolic, but it speaks to the sense of optimism and possibility that surrounds this company and this technology.

The Dawn of Sentient Silicon

So, what's the real story? It's not just about Nvidia's stock price or quarterly earnings. It's about the fact that we are witnessing a technological Cambrian explosion. A moment in time where the possibilities are limited only by our imagination. And that, my friends, is something to be truly excited about.